receiving letter from law firm about debt collection

Answer Simple Questions to Make A Debt Collection Worksheet On Any Device In Minutes. However it is a good idea to have a lawyer do it.

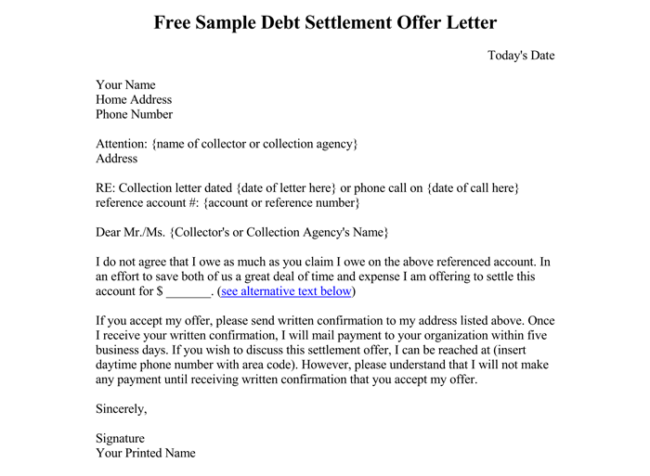

Printable Sample Settlement Letter Form Business Letter Template Business Letter Sample Letter Templates

In light of that weve laid out the steps you should take.

. On behalf of Bank of America NA we appreciate your cooperation in resolving this matter. The letter will usually state that the creditor has retained the law firm in order to represent it in collecting the debt. We agreed verbally on a settlement of 3200 of which I sent a check for 2500 and the remaining to be sent in monthly payments of 50.

A debt collection letter is sent to. There are also a few special rules for law firms acting as collection agencies. However if you have defaulted on your payments receiving a letter from a law firm about debt collection can be traumatizing.

Also save all debt collection letters either in hard copy or electronically. If you do not plan to. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Receiving a collection letter can be considered the first step in the collection process that could lead to a lawsuit being filed against you to collect the debt. But a letter from a lawyer for debt collection does not mean you will be taken to court the next morning. Using Our Clear Step-by-Step Process to Create Your Demand Letter Online.

The mail is from a San Diego law firm and right there in the envelopes address window it says ominously You may. This release letter acknowledges that the above referenced account has been satisfied. All too often these letters infer that if you dont pay you will be taken to court.

He should wait to make a decision whether or not to accept the offer until he receives their offer letter outlining the terms. The Fair Debt Collection Practices Act FDCA prohibits debt collectors from using unfair abusive or deceptive practices to collect a debt. 23 2018 3 AM PT.

The Purpose of a Debt Collection Letter. Inform debtors of an outstanding debt. A lawyer can review the law or the contract to make sure that if a demand letter is necessary the demand letter will comply with any formal requirements.

So you got a letter from a collection agency because it thinks you owe a debt and its try to collect the debt from you. The debt collector may also offer to accept a settlement from him for a reduced amount. Frequently these notices are sent in order to try and frighten or intimidate you into paying even though you have the legal right to dispute the debt within 30 days of receiving the letter.

It costs money to file a lawsuit and collection firms do not want to pay it right away. If the offer is originally made verbally over the phone have your son ask to receive it in writing from the collection agency. You may not know what to do next if you are not in a position to clear the outstanding amount immediately.

This letter is referred to as a G-Notice and requires that. After you understand more of what the letter is about you should contact your own lawyer to discuss it. The first thing you should do after receiving a debt collection letter from a lawyer is read through it.

If your law firm is regularly engaged in debt collection as a practice area you. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. And of course it states my name address account number with BofA and with the agency as well.

Begin the letter by typing the title of the issue to which you are responding. I received a letter in April from a lawyers office for a debt from 2005 It was for 11000 of which 8500 is all interest. Release of Debt Letter from Collection Law firm.

If youve received a call or letter from an attorney regarding a debt that you owe youre probably wondering how to respond. Generally you are given 30 days to respond and dispute the debt or point out inaccuracies. A bankruptcy lawyer like one from The Law Offices of Neil Crane might ask you some questions that will help him or her understand your.

The attorney may send their own collection letter in an attempt to get payment. Read each debt collection letter you receive carefully. A collection agency from whom you have received a letter will typically turn the file over to an attorney if they are unable to acquire a payment.

Normally the letter will also state that the debtor has 30 days to dispute the debt and gives instructions on how such a. Ad Legal Made Simple. Thank you for subscribing.

This rule exists because collection agencies know that a letter from an attorney is more likely to frighten the. Step by Step Instructions. It highlights when the payment was due and urges the debtor to clear.

A debt collection letter is a formal notice that businessesincluding law firms give to a client who hasnt paid their bill by the agreed-upon date. Ad Professional Fill in the Blanks Collections Letter Form. As far as I know the debt never went to a collection agency but straight to a collection law firm saying that they are suing due to failure to respond to original collection request and failure to pay immediately which I cant do until I start working I graduate this year and will start working in the summer while also having a baby.

A debt collection letter on a provider law firms letterhead can make a significant impact. You have not been sued yet. Your question about whether to send a verification letter is tricky as I have heard clients tell me that they sent the letter to the debt collection law firm then when they called to settle the debt the law firm collector was fixated on the fact that the verification letter was sent and would not discuss settlement.

Leave a space then type the collectors name with his office address under it. Please be aware that if payment does not arrive by date of 60 days past due legal action may be taken to enforce your obligation to pay. This letter is a red flag particularly if the law firms address is in your state.

This type of letter informs the recipient of their outstanding debt requests that they pay by a certain date and lets them know what will happen should they fail to pay. Debt collection letters can be issued to both commercial and consumer debtors. Create Legal Documents Using Our Clear Step-By-Step Process.

In fact in most situations the FDCPA requires a debt collector to send at least one letter to the person that it claims owes money. Unfortunately debt collectors are allowed to mail you collection letters requesting that you repay the alleged debt the collectors claim that you owe. I have not been able to send the 50 per the verbal agreement.

The letter also demands payment. Both Federal and State law require that any time the law firm sends a collection letter to the consumer regarding the debt they must be clear that they are acting only as a debt collector. Typically these letters are sent within five days of the first collection call you receive.

Most debt collectors use mail as their primary collection tool. If you write back requesting proof of the obligation you are only buying time. Dear client name This is another reminder our law firm has yet to receive the XXXX on invoice No.

Then you should be able to call the clerks office of the county you were sued in and ask them about. There is no requirement for a debt collection lawyer to prepare and send the demand letter to the debtor. They would rather reach out to you and see if a payment plan can be reached.

Begin the letter by typing the date in the top left corner with your address below it. LegalShield small business members often receive better results by having their lawyer assisting in the debt collection process. This letter is usually a form letter that is sent out before litigation has begun.

1234 for Downtown Law Firm. The primary purpose of the debt collection letter is to inform a debtor their payment is due formally. Fortunately no matter which method of communication the law firm has used to get in contact with you the process for responding is pretty much the same on your end.

First you could contact the lawyers who wrote you and ask them to give you the case number of the lawsuit and the county where you were sued. Once your debt is assigned to a collection law firm you will typically receive a letter requesting payment of your debt. Working with a lawyer who can guide and assist your business related to debt collection efforts is a great first step.

However the FDCA only applies to debt collectors defined as those who regularly collect debts.

Free Debt Collections Letter Template Sample Pdf Word Eforms

Free Debt Release Letter After Final Payment Pdf Word Eforms

Debt Collection Letter Samples For Debtors Guide Tips

How To Write A Defamation Of Character Letter Beautiful Cease And Desist Letter Template 6 Free Word Pdf Defamation Of Character Letter Templates Lettering

Free Debt Release Letter After Final Payment Pdf Word Eforms

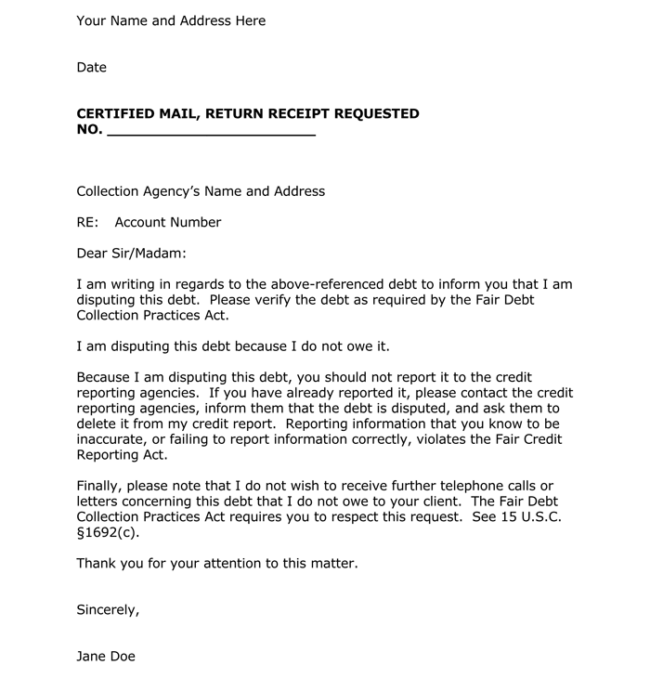

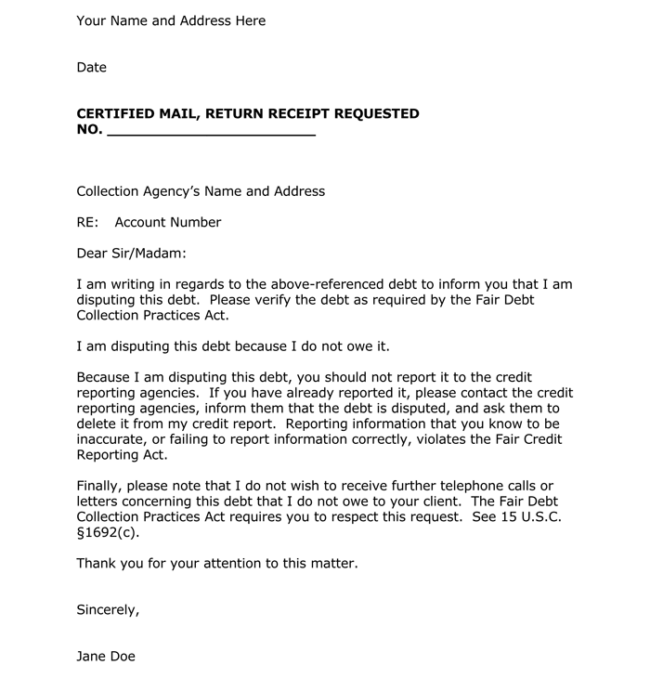

Collection Agency Letter Sample Letter Requesting A Collection Agency To Validate That You Owe The Debt Collection Letter Lettering Letter Templates

Bad Check Collection Letter Prior To Accepting A Bad Check For Collection The Payee Must Business Letter Format Credit Repair Letters Business Letter Sample

Explore Our Example Of Charge Off Dispute Letter Template Credit Repair Letters Credit Repair Business Check Credit Score

Free Debt Collections Letter Template Sample Pdf Word Eforms

Sample Pay For Delete Letter For Credit Report Cleanup Regarding Dispute Letter To Creditor Template 10 Letter Templates Dispute Credit Report Credit Dispute

Sample Debt Collection Letter From Attorney Download Printable Pdf Templateroller

Debt Collection Letter Samples For Debtors Guide Tips

How To Write A Defamation Of Character Letter Inspirational Slander Letter Template Defamation Of Character Character Letters Letter Templates

Letter Template Pay To Delete Letter 3 Brilliant Ways To Advertise Letter Template Pay To De Credit Repair Letters Letter Templates Credit Repair Business

Demand For Payment Letter Check More At Https Nationalgriefawarenessday Com 5696 Demand For Payment Lett Letter Templates Free Word Template Design Lettering

New Debt Validation Letter Sample Download Https Letterbuis Com New Debt Validation Letter Sample Download Lettering Letter Sample Letter Templates

Free Debt Collector Creditor Cease And Desist Letter Pdf Word Eforms

Free Sample Letter Effective Letter Writing Tips Learn Letter Writing Business Letter Format Debt Settlement Debt Relief Debt Repayment